Five finance tips for a new job

Believe it or not, many individuals are often unaware of what their net pay will be when they start a new job. This uncertainty stems from the various deductions that reduce gross income, such as taxes, benefits, and other payroll deductions. Without a clear understanding of these factors, estimating take-home pay can be quite challenging.

This lack of clarity can be particularly unsettling for those preparing to embark on a new chapter in their lives. Accepting a new job often comes with significant financial changes, and not knowing what your paycheck will look like can add to the stress of this transition. It underscores the importance of financial planning and having a good grasp of how employment compensation works.

Navigating the new finances that accompany a job change requires a proactive approach. Understanding the specifics of your benefits, the impact of taxes, and any other deductions on your overall pay is crucial. This knowledge not only helps in setting realistic expectations but also in making informed decisions about budgeting and financial planning as you adjust to your new role.

Finance coach Jeannie Dougherty believes in controlling what you can during this transition period of your life.

Here are 5 financial tips to keep in mind when starting a new job:

- Pay yourself first

- Prioritize the bills that affect your credit and home life

- Cut unnecessary subscriptions and expenses

- Save one to three months salary

- Wait at least six months before making large purchases

Paying yourself first

In the unsettling event of a layoff, adopting the principle of “paying yourself first” becomes crucial in managing your finances during uncertain times. This means, before anything else, allocating a portion of your severance pay or unemployment benefits towards your savings. This approach ensures that you have a financial cushion to support you as you search for new employment opportunities, helping to mitigate the stress associated with income loss.

Prioritizing the bills that affect your credit and home life

Prioritizing bills that affect your credit and home life is especially important during a layoff period. Ensuring that mortgage or rent payments, utility bills, and any other obligations that could impact your credit score are paid on time is critical. Maintaining a good credit score and keeping your living situation stable are essential during this time of transition, as they can affect your ability to secure housing or loans in the future.

Cutting unnecessary subscriptions and expenses

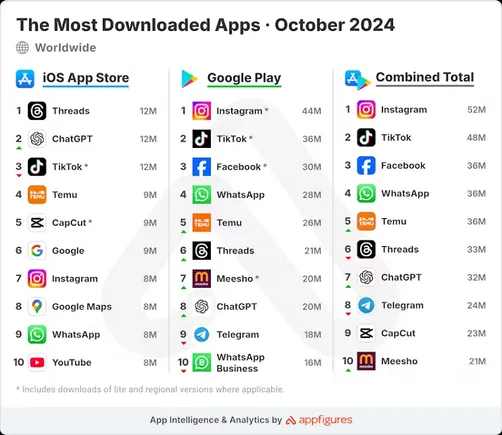

Cutting unnecessary subscriptions and expenses becomes even more vital when facing a layoff. With a potentially reduced income, evaluating your spending and eliminating non-essential costs can help stretch your remaining funds further. This process involves scrutinizing monthly subscriptions, such as streaming services or gym memberships, and reducing discretionary spending to preserve financial resources for essential needs.

Saving one to three months salary

Saving one to three months’ salary as part of an emergency fund is a financial safety net that proves invaluable in the event of a layoff. Having this reserve can give you the breathing room needed to focus on your job search without the immediate pressure of financial hardship. If you haven’t already established such a fund, prioritizing this goal with any remaining income or severance pay can provide a sense of security during uncertain times.

Waiting at least six months before making large purchases

Lastly, waiting at least six months before making any large purchases is wise advice following a layoff. This period of financial restraint allows you to assess your long-term employment prospects and ensure that you can sustain your lifestyle without depleting your savings. Postponing significant expenditures helps avoid additional financial strain, allowing you to maintain flexibility and stability as you navigate your way back into employment.